An effective plan incorporates the priorities of today and adapts over time to reflect the priorities of tomorrow. We will start with your goals, your concerns and the things that matter most to you.

Once we know what you are striving for, you will receive a comprehensive plan for your future that will bring your goals into focus while minimizing the impact of any challenge’s life may present.

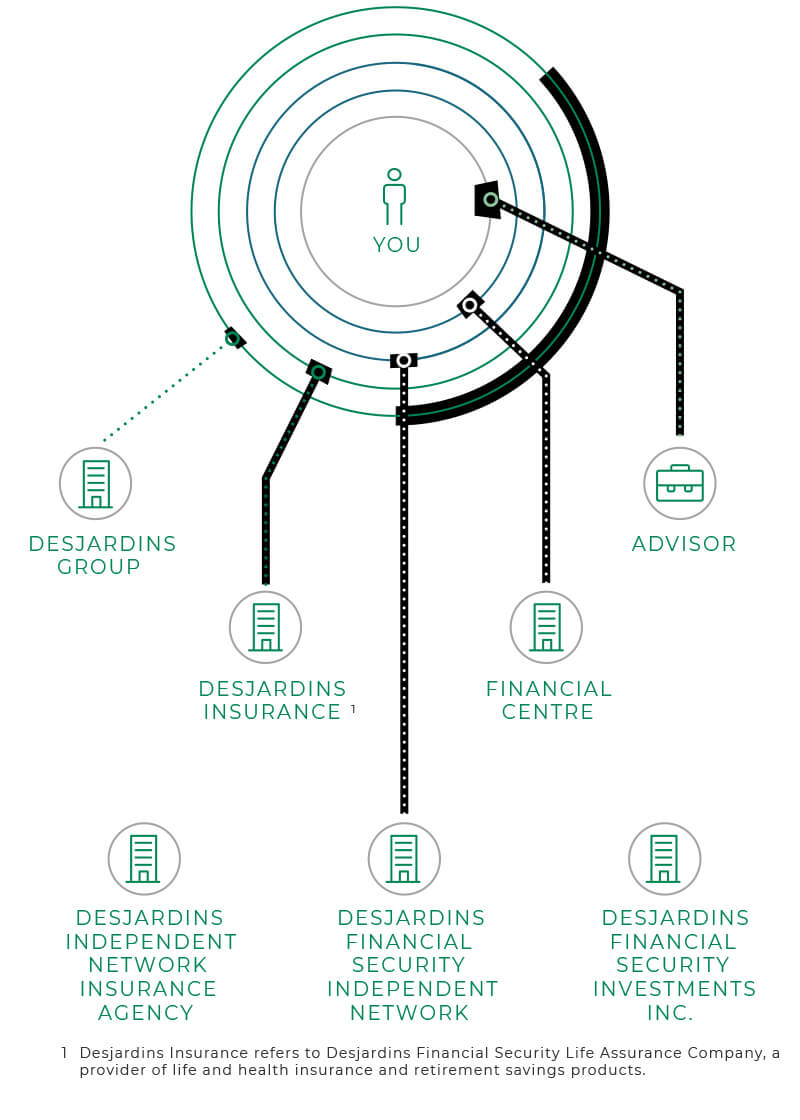

Backed by a team of experienced professionals, which may include notaries, lawyers, and tax experts, we will make sure that your plan is the right one for you, not just for this year, but for your life as it changes. Our comprehensive wealth management services include:

Your Personal Finances

Budget planning/ Debt review and management/ Emergency funds/ personal savings.

> Read MoreYour Investments

Investment strategies, investor profile, frequent reviews/ second opinion on your portfolio/

automated personal savings/portfolio rebalancing.

Your Insurance Needs

Personal insurance – life, disability, critical illness

Business insurance – corporate life, key person, income replacement, critical illness

Optimizing Your Taxes

General assessment/ taxes on investment portfolios/ tax-efficient investments/ capital gains strategies/ long-term tax savings.

> Read More

Legal Aspects

Wills, Powers of Attorney, Personal Directives/ Business and personal affairs/ Marriage and common-law relationships. *Your advisor may refer you to legal professionals

> Read MorePlanning Your Retirement

Determining your goals and needs/ Risk management/ RRSP’s and TFSA’s/ Accumulation strategies.

> Read More

Your Estate

Estate planning/ wills, POA’s, personal directives/ Executors, trustees, guardians, and beneficiaries/ efficient transfer of assets.

> Read MoreThe Value of Financial Advice

You deserve the very best. We take a tried and true approach built on discipline and expertise and focuses on what is most important to you: your quality of life and your goals.

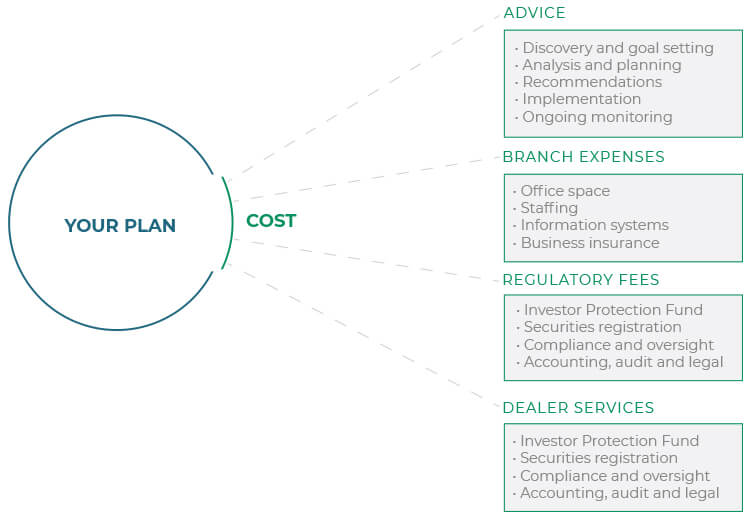

The Cost of Financial Advice